are union dues tax deductible in canada

Taxation of Union Dues You can deduct any union dues paid by you from your taxable income. Membership dues for trade unions or public servant associations may be deducted on income tax returns.

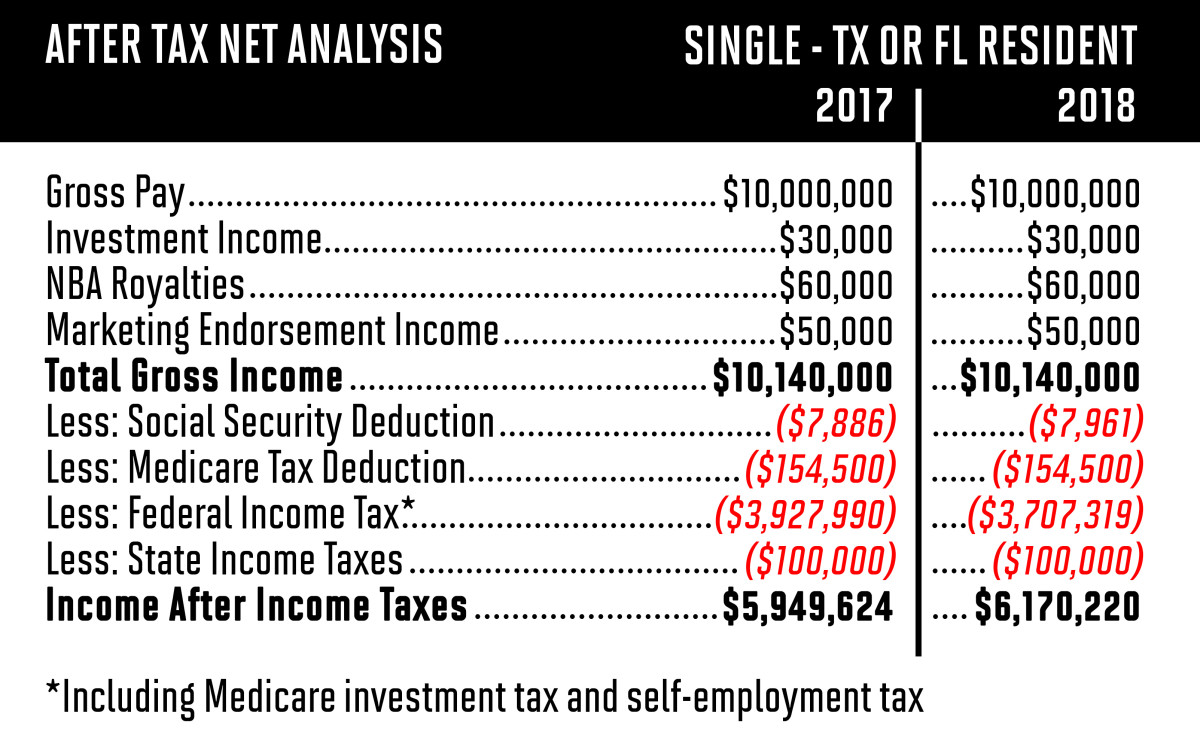

Trump S New Tax Bill The Impact On Star Athletes Sports Illustrated

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can.

. At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. What does the employer do with the union.

However if the taxpayer is self. You may be eligible for a rebate of any GSTHST that you paid as part of your dues. However if the taxpayer is self.

The weekly deductions are equal to his RPP contributions of 2500 plus union dues deductions of 550 plus his deduction for living in a prescribed zone of 7700 1100 per day 7 days. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. However if the taxpayer is self.

However if the taxpayer is self. Tax reform changed the rules of union due deductions. Annual union professional or like dues.

The TCJA made union dues non-tax deductible Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. For example if your annual income is 40000 and you paid 1000 as union dues your taxable.

However if the taxpayer is self. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

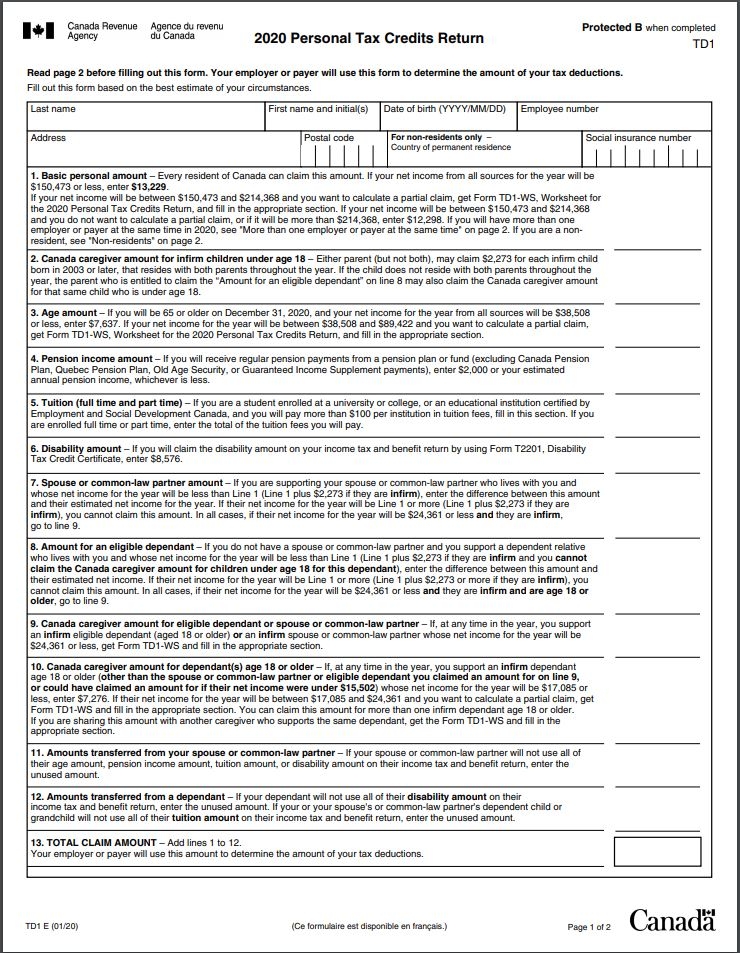

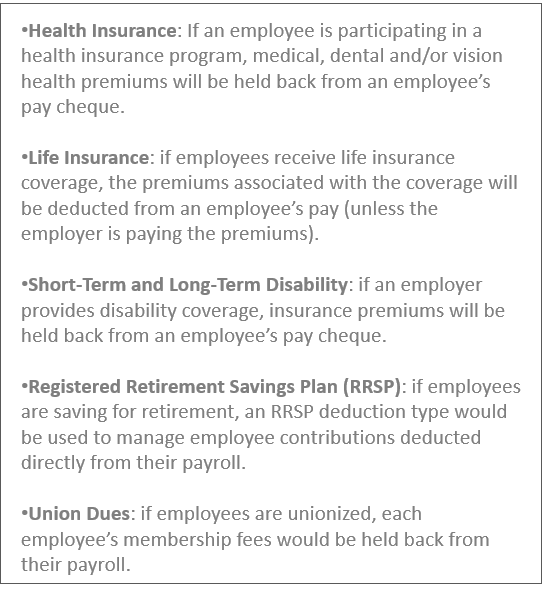

Union dues are set by the bargaining agents and calculated either by using a fixed rate or as a percentage of the employees salary. If you are a member of a trade union or professional organization you can deduct certain types of union contributions or professional membership dues from your income tax. Completing your tax return Claim on line 21200 of your return the amount shown in box.

In other words union dues offer no tax benefitthough some employees may itemize them as after-tax deductions when filing their annual returns. Union dues and professional association fees are tax deductible. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

The general rule for claiming such a deduction is described in the annual income tax return guide. Line 212 Claim the total of the following amounts related to your employment that you paid. However if the taxpayer is self.

100 rows Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay. Are union dues tax. If you belong to a union or professional organization you can deduct certain types of union dues or professional membership fees from your income tax filings.

The amount of union dues that. Professionals who are required by law to pay dues for professional.

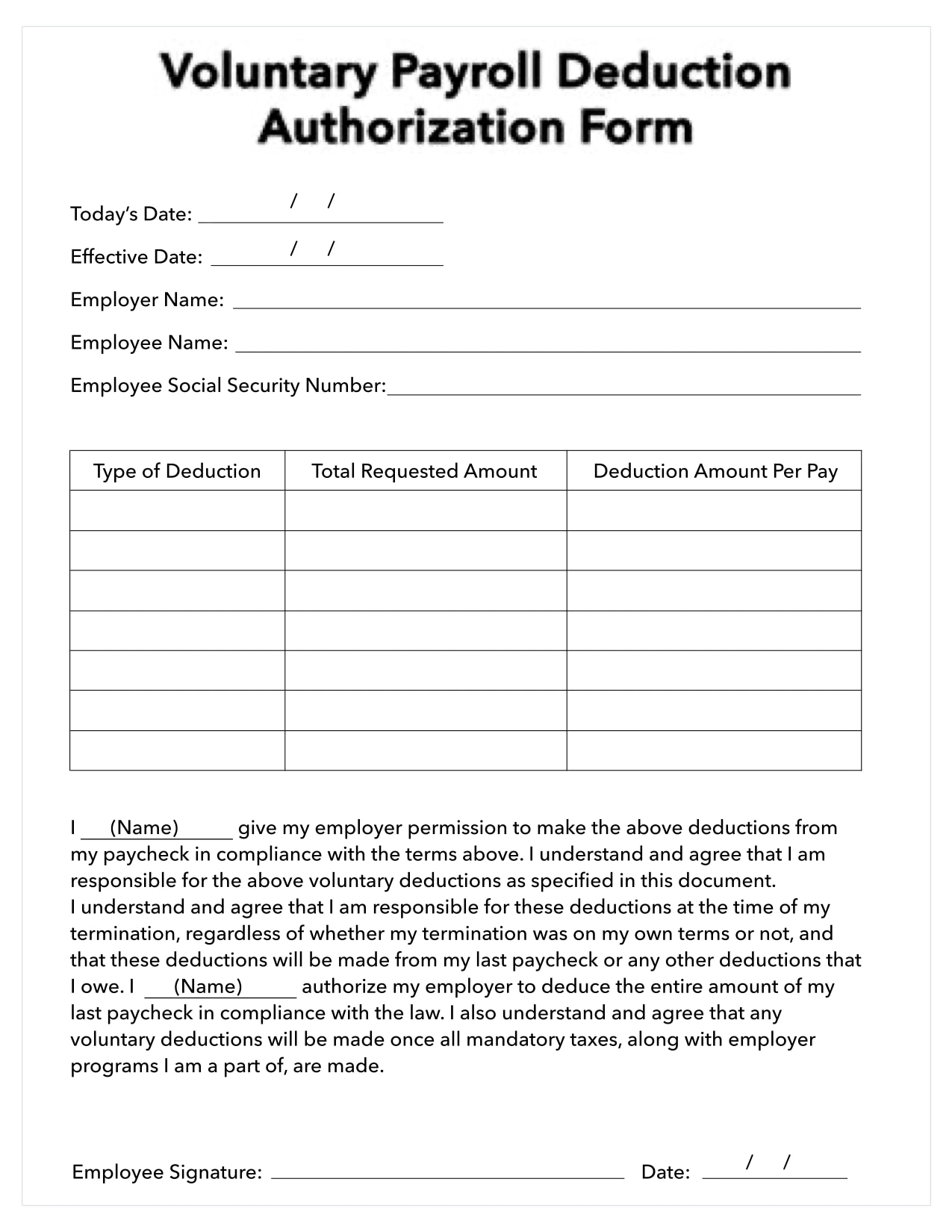

Set Up Deductions Benefits And Accruals

What Are Payroll Deductions Article

Common Small Business Tax Credits Quickbooks Canada

Tax Deductible Donations Can You Write Off Charitable Donations

Payroll A Dollar Earned Ppt Download

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Your Union Dues Plain And Simple

Your Bullsh T Free Guide To Canadian Tax For Working Holidaymakers

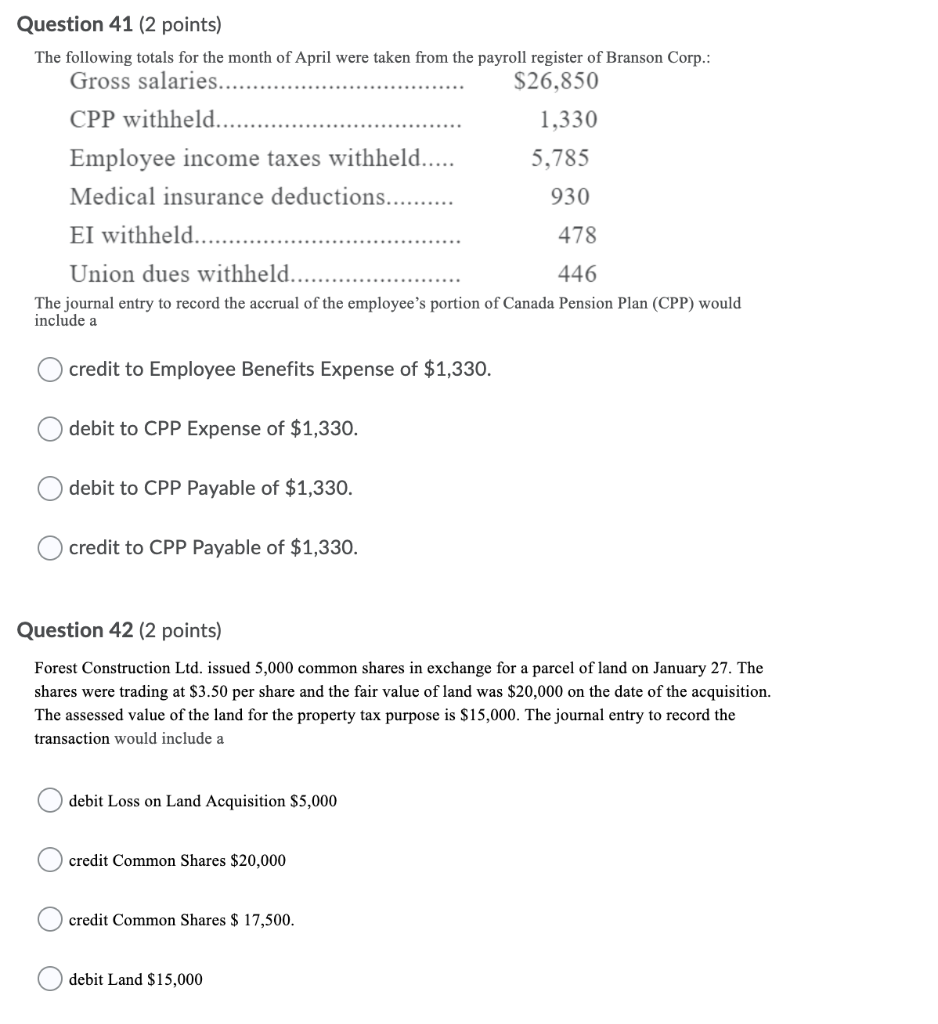

Solved Question 41 2 Points The Following Totals For The Chegg Com

Vtac Payroll Management Photos Facebook

Everything You Need To Know About Running Payroll In Canada

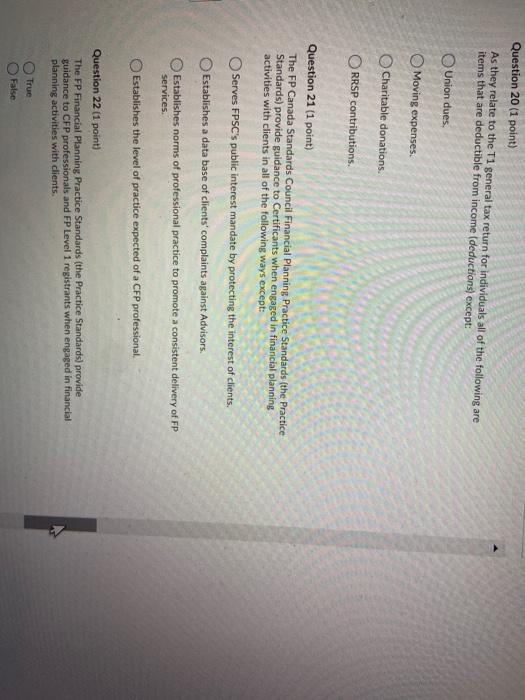

Solved Question 20 1 Point As They Relate To The T1 Chegg Com

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

:max_bytes(150000):strip_icc()/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

A Tax Break For Union Dues Wsj

Math 10 Unit 4 Fm 4 Students Are Expected To Explain Why Gross Pay And Net Pay Are Not The Same Determine The Canadian Pension Plan Cpp Employment Ppt Download